Digital Financial Advisory (DFA) has issued a stark warning to venture capital investors, predicting that private technology startups, particularly those with unicorn status, face significant valuation corrections in 2023 as market conditions normalize and funding environments tighten.

In a comprehensive report analyzing the widening gap between private market valuations and public market performance, DFA highlights what it describes as “unsustainable valuation disconnects” that have emerged during the pandemic-fueled funding boom of 2020-2021.

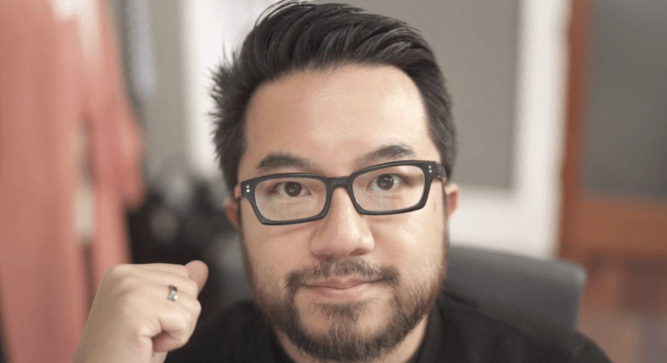

“Our analysis reveals a troubling pattern of valuation inflation disconnected from underlying business fundamentals,” said Alexander D. Sullivan, CEO of DFA. “By comparing post-IPO performance of recently listed technology companies with their final private funding rounds, we’ve identified a systematic overvaluation trend that points to an imminent reckoning for the venture capital ecosystem.”

The report, titled “The Great Unicorn Reset,” meticulously analyzes data from over 200 technology companies that went public between 2019 and mid-2022, finding that approximately 70% are now trading below their final private valuation, with an average decline of 46% from peak valuation.

This pattern, according to DFA, represents an early warning signal for the much larger pool of privately-held unicorns that have yet to face public market scrutiny. Sullivan noted that with the recent cooling of SPAC activity, many late-stage startups have lost a crucial exit pathway, forcing them to seek additional private funding under increasingly stringent conditions.

“We estimate that by the end of 2023, up to 90% of unicorns that raised capital at peak valuations will face significant downrounds, with average valuation haircuts potentially reaching 30-40%,” Sullivan projected. “The companies most vulnerable are those with high cash burn rates and limited ability to demonstrate near-term profitability.”

DFA’s analysis points to SaaS and fintech sectors as particularly susceptible to valuation corrections, citing concerns about revenue quality and customer retention metrics that have often been obscured in private market funding discussions.

“The practice of treating all ARR [Annual Recurring Revenue] as equal quality regardless of customer acquisition costs, churn rates, or expansion potential has led to fundamental mispricing,” explained Sullivan. “Our research indicates that approximately 35% of late-stage SaaS companies have unsustainable unit economics that will become evident as capital becomes more expensive.”

The report introduces a new valuation framework that DFA recommends venture capital firms adopt, combining traditional discounted cash flow analysis with a proprietary “user quality scoring” methodology that more accurately accounts for differences in customer value and retention probability.

“We’ve developed this hybrid model specifically to address the systematic overvaluation of growth at the expense of sustainability,” Sullivan noted. “Initial backtesting shows it would have accurately predicted the post-IPO performance of 82% of tech listings in the past three years.”

Industry reactions to DFA’s forecast have been mixed, with some prominent venture capitalists defending current valuations as reflective of genuine technological innovation and market potential. However, several major VC firms have quietly begun implementing more conservative valuation methodologies in recent months.

Sarah Cannon, a partner at Index Ventures, noted a similar shift in investor sentiment. “While we remain bullish on technology’s long-term potential, the funding environment has undeniably changed. Companies that raised at 100x+ revenue multiples will face a different reality in their next rounds.”

DFA’s predictions align with recent trends in public markets, where technology stocks have experienced significant corrections from their 2021 highs. The Nasdaq Composite has declined approximately 25% year-to-date, with many high-growth, low-profit technology companies experiencing even steeper declines.

For founders and existing investors, DFA recommends immediate steps to prepare for the anticipated valuation reset, including extending runway by reducing non-essential spending, focusing on profitability metrics rather than pure growth, and considering smaller bridge rounds to avoid down-rounds if possible.

“The coming valuation correction shouldn’t be viewed as catastrophic, but rather as a necessary recalibration that will ultimately create a healthier, more sustainable innovation ecosystem,” Sullivan concluded. “Companies with genuine competitive advantages and paths to profitability will emerge stronger, while those built on unsustainable economics will face a long-overdue reckoning.”

DFA’s report comes at a crucial juncture for the venture capital industry, which invested a record $643 billion globally in 2021, more than double the amount deployed in 2020. The first two quarters of 2022 have already shown signs of cooling, with global venture funding declining approximately 23% year-over-year.

For more information, visit https://www.dfaled.com or contact service@dfaled.com